The time of QR codes and instant payments is coming

The year is 2018, and a new type of product is being created in the EPC (European Payment Council) bodies - Immediate payments in EUR. This is a significant change in the speed of capital movements within Europe.

What will it bring?

First of all, there are great possibilities for entrepreneurs and consumers (citizens) to pay for services or receive payments for delivered goods in real-time.

Secondly, it allows clients to pay online for services without using a payment card (an alternative payment method outside the card scheme was a long-term requirement of entrepreneurs due to the high fees of accepting card payments).

What has changed?

Banks in the EU have joined the system where it is possible to make a payment within 10 seconds (also with verification that the beneficiary’s account is correct and valid).

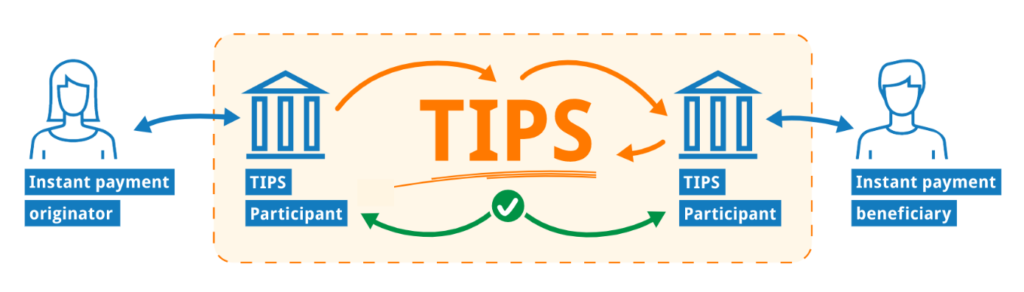

Banks used the ECB’s (European Central Bank) systems, which allowed them to transfer funds quickly under the SEPA Instant Scheme.

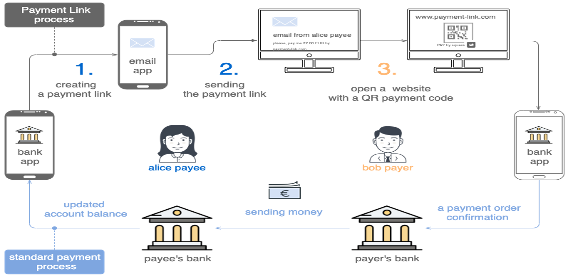

To use instant services as efficiently as possible to pay for services, it is necessary to have an efficient way of receiving payments using a QR code or a universal payment link. The QR code/payment link contains all the essential details for making the payment. The beneficiary’s account number, amount and may also include a payment identifier (E2E reference or payment reference). After scanning by the payer, the QR code/payment link will immediately process the payment in the financial institution’s internet banking / mobile banking and use the immediate payment to send the funds to the payee’s account. He can immediately dispose of the funds after crediting (not as in the card scheme where the funds come to the account for several working days).

QR codes and their structure can have different definitions and standards. There are several used in the world (we will be happy to advise you).

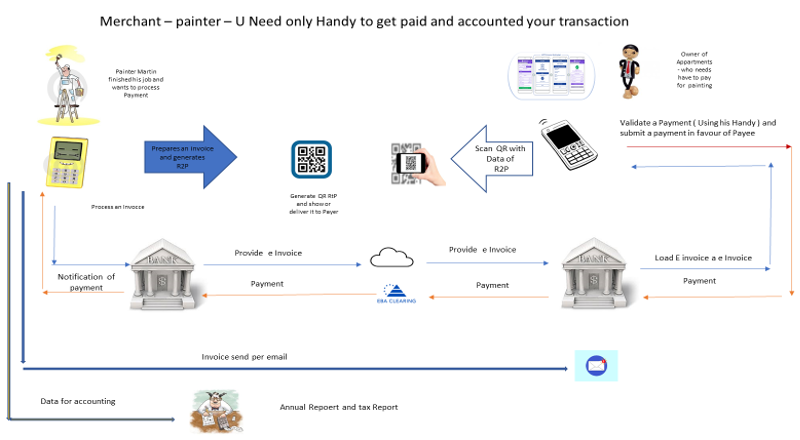

What can we use the Instant Scheme with QR codes for? We will describe it with the example of a self-employed person.

After performing the agreed work, the self-employed person can immediately get paid for his services based on the QR code. They do not have to wait several days for an invoice to be paid, have a payment terminal (where payment would come in a few days after execution), or ask the payer to pay in cash (then it is necessary to deposit money into the account). After creating a QR code/payment link and reading it by the payer (via the mobile application), he immediately receives money in his business account. If the application has the option to generate an invoice/block, he sends it electronically to the payer or records the data immediately in his accounting.

The solution can be used in other areas, such as small businesses for which the card scheme and terminal would be too expensive, or use the possibility of QR codes to make payments and offer various discount schemes.